| News

Stian Enger Pettersen, head of casino at EveryMatrix dives into the key factors needed to engage online casino players in Greece in the latest edition of Slot Trumps.

As we reach the third global iGaming market as part of our Slot Trumps research, we are rapidly building up a detailed picture of player preferences. Our reports have spanned some of the world’s fastest growing regulated and newly regulating territories.

If Romania was split between a mix of classic slot fans and Bonus Buyers, and Brazil was made up of ‘thrillseekers’, then Greece is the first market where we have seen regulation impact online casino player behaviour.

In 2022 the Greek government increased the maximum stake limit on all slot games to €20. This reversed its 2020 guidance of a €2 max bet. It also doubled the jackpot value on games of chance and slots from €70,000 to a €140,000 cap. Slot spin speeds were also increased from three seconds to two seconds.

Although conditions both for players and the industry have improved, player behaviour is still conditioned by regulatory requirements. This has also been evident within our findings.

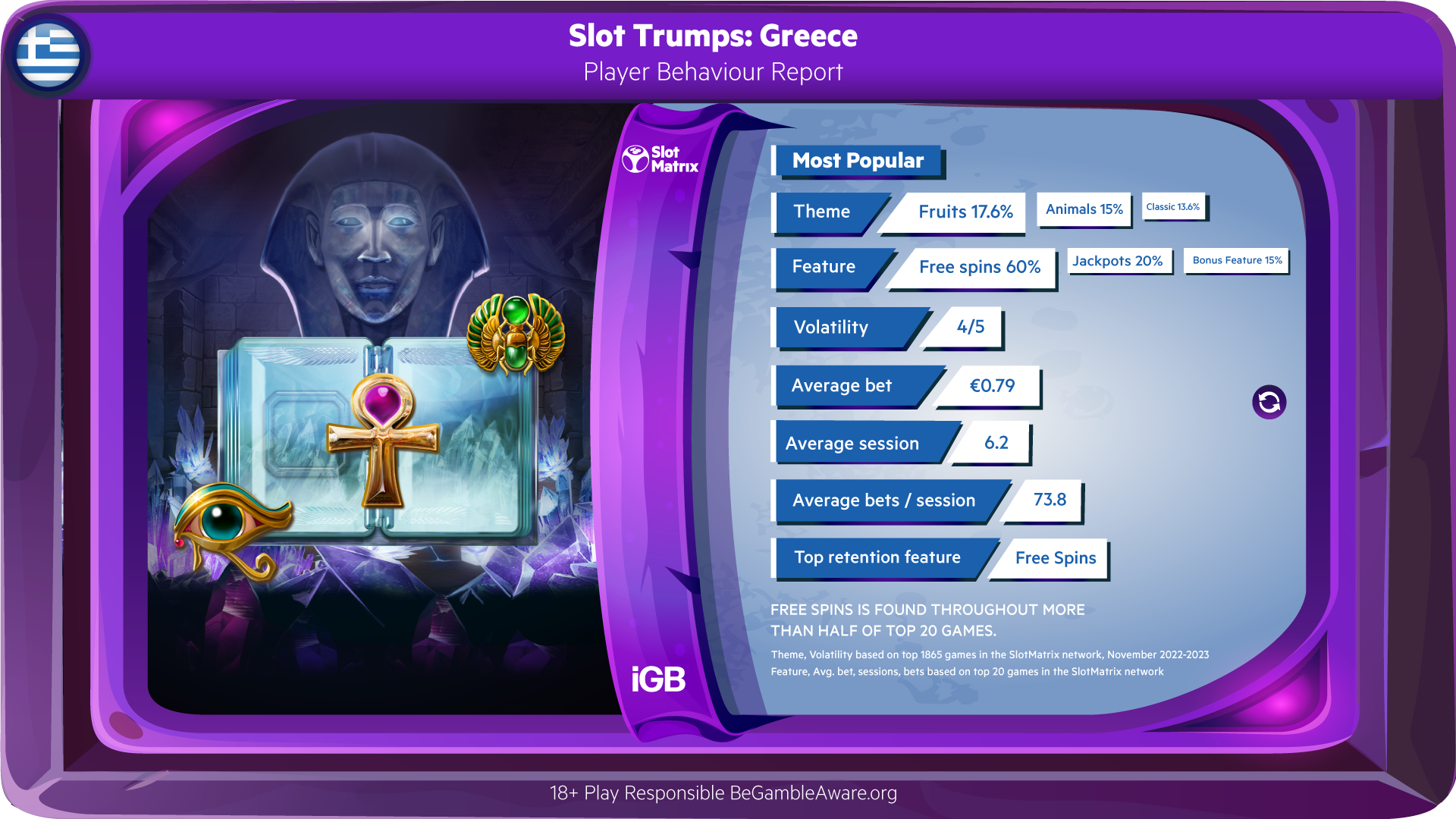

For example, Greek players cannot access ‘Buy features’. The max bet cap influences in-game bonus features as well as average bet levels of €0.79 per spin. This is while only 20% of the 20 most played games have an average bet of more than €1.

In contrast, Greek players’ inability to access certain bonus features means more traditional mechanics thrive. A total of 60% of the top 20 games within the SlotMatrix Greece network contain Free Spins. This is while only 20% offer jackpots and 15% offer game-specific bonus features that enable players to access bonus rounds.

Romanian players spend three times more per spin across their top 20 games (€2.59) than in Greece. This is with very few regulatory rules restricting activity. In contrast in Brazil, where gaming laws are still being established, players on average also spend more per spin (€1.09).

These numbers, however, mask the huge appetite for real-money games in Greece. This is a country with a lower adult population than both Romania and Brazil. We see this with the average number of sessions (6.2), bets per player (459) and bets per session (73.8) across SlotMatrix’s top 20 aggregated games within a 90-day timeframe.

For a country of its size, and despite restrictions preventing players from accessing features that other markets enjoy, it punches far above its weight. The latest official country data shows gross gaming revenue (GGR) is 16% higher year-to-date. Compared to the the same period last year, this has risen to €619m, with Q3 GGR up 4% to €212m.

Pettersen explores the optimum strategies operators can use to consistently engage Greek players within a changeable regulatory market.

Without question, in markets such as Greece, having a firm grasp of the regulatory issues and ensuring you are compliant is vital. Our CasinoEngine productivity platform, for example, enables operators to take full control of the gameplay window on both desktop and mobile.

This allows for real-time notifications in line with regulatory and safer gambling requirements. That includes reality checks, time limit calculations, wagering limits across all vendors, authenticity checks and bespoke daily reporting. We also have toolbars with specific buttons such as money transfer and the ability to switch between fun and real money modes.

Furthermore, it also allows brands to add buttons on top of the gameplay window for added features. These include quick deposit and cashier functions, gameplay information, gamification features and more.

This is also fully supported with precise and real-time reporting. For example, once a game is launched, CasinoEngine allows operators to retrieve wallet and detailed session data. This includes gambling notification interval (e.g. 5 mins), session times (e.g. 10 min), session information (stakes/winnings), and user info (e.g. user balance, country of residence).

This ability to swiftly design and deliver any tool or feature an operator requires within the Greek market is essential. We have been working with market leaders OPAP and others for several years to offer and amplify highly engaging and personalised, but equally safe and responsible, gameplay. This also ensured we delivered record revenues for them.

As we have discovered in 15 years of integrating, distributing and delivering the largest content library in our industry, localised content strategy is crucial. Not only does every market have its own regulatory requirements, but players also select and engage with games they are most familiar with and that fit into their cultural preferences.

Lobby management goes together with localisation and is vital in a market such as Greece. This is especially the case given that conditions and trends change quicker than most. Integrating an aggregation offering supported by a flexible and highly efficient platform is a must. This is especially the case if you want to fully control and personalise your offering.

SlotMatrix enables brands to choose the ideal content for each market. This is supported by a powerful productivity platform that offers flexibility and personalisation. This means operators can target player segments and instantly present them with the games they enjoy the most. Not only that, it also continually adds new content and offers them those titles whenever relevant.

This then empowers brands to manage what is presented to each player within the front-end. Brands are enabled with creating any number of lobby variations; tailor categories and game order for specific markets or player segments; build web and mobile lobbies for games, live dealer tables and VIPs, for instance; and change the order of games in a way that suits their strategy best.

Align your online casino strategy with the right foundations, tools and functionality and you will instantly reap the rewards in Greece.

Go to Slot Trumps Player Behaviour Report for a more detailed breakdown of Romanian player and wagering behaviours.